Google 3rd quarter results summary,

MOUNTAIN VIEW, Calif. - October 16, 2008 - Google Inc. (NASDAQ: GOOG) today announced financial results for the quarter ended September 30, 2008.

"We had a good third quarter with strong traffic and revenue growth across all of our major geographies thanks to the underlying strength of our core search and ads business. The measurability and ROI of search-based advertising remain key assets for Google," said Eric Schmidt, CEO of Google. "While we are realistic about the poor state of the global economy, we will continue to manage Google for the long term, driving improvements to search and ads, while also investing in future growth areas such as enterprise, mobile, and display."Q3 Financial Summary Google reported revenues of $5.54 billion for the quarter ended September 30, 2008, an increase of 31% compared to the third quarter of 2007 and an increase of 3% compared to the second quarter of 2008. Google reports its revenues, consistent with GAAP, on a gross basis without deducting traffic acquisition costs (TAC). In the third quarter of 2008, TAC totaled $1.50 billion, or 28% of advertising revenues.

Google reports operating income, net income, and earnings per share (EPS) on a GAAP and non-GAAP basis. The non-GAAP measures, as well as free cash flow, an alternative non-GAAP measure of liquidity, are described below and are reconciled to the corresponding GAAP measures in the accompanying financial tables.

GAAP operating income for the third quarter of 2008 was $1.74 billion, or 31% of revenues. This compares to GAAP operating income of $1.58 billion, or 29% of revenues, in the second quarter of 2008. Non-GAAP operating income in the third quarter of 2008 was $2.02 billion, or 37% of revenues. This compares to non-GAAP operating income of $1.85 billion, or 34% of revenues, in the second quarter of 2008.

GAAP net income for the third quarter of 2008 was $1.35 billion as compared to $1.25 billion in the second quarter of 2008. Non-GAAP net income in the third quarter of 2008 was $1.56 billion, compared to $1.47 billion in the second quarter of 2008.

GAAP EPS for the third quarter of 2008 was $4.24 on 318 million diluted shares outstanding, compared to $3.92 for the second quarter of 2008 on 318 million diluted shares outstanding. Non-GAAP EPS in the third quarter of 2008 was $4.92, compared to $4.63 in the second quarter of 2008.

Non-GAAP operating income, non-GAAP operating margin, non-GAAP net income, and non-GAAP EPS are computed net of stock-based compensation (SBC). In the third quarter of 2008, the charge related to SBC was $280 million as compared to $273 million in the second quarter of 2008. Tax benefits related to SBC have also been excluded from non-GAAP net income and non-GAAP EPS. The tax benefit related to SBC was $63 million in the third quarter of 2008 and $48 million in the second quarter of 2008. Reconciliations of non-GAAP measures to GAAP operating income, operating margin, net income, and EPS are included at the end of this release.

Labels: Goog

Google value tumbles on US financial crisis

Labels: Goog

Top 10 brand pyramid - 2008 top brands

Labels: Goog, google images

Another company wants a piece of Google pie - Mediaset

First we had Viacom then we had the Belgium newspaper group and now we have another company suing Google. Mediaset a media company is suing Google and Youtube for using copyrighted materials on their website.

According to reuters

"Mediaset, controlled by Prime Minister Silvio Berlusconi, joins others broadcasters seeking compensation from YouTube, a video-sharing website, for copyright infringement.

Mediaset filed suit in a Rome court, the company said in a statement on Wednesday. A YouTube spokeswoman said it did not see the need for the legal case.

"YouTube respects copyright holders and takes copyright issues very seriously," the spokeswoman said in London. Google bought YouTube in 2006.

"There is no need for legal action ... We prohibit users from uploading infringing material and we cooperate with all copyright holders to identify and promptly remove infringing content as soon as we are officially notified," Google said in a separate statement.

Lawsuits and trials in Italian are often lengthy and it is forecast the outcome.

Mediaset said a sample analysis of YouTube at June 10 found "at least 4,643 videos and clips owned by us, equivalent to more than 325 hours of transmission without having rights".

Mediaset said this was equal to the loss of 315,672 days of broadcasting by its three TV channels."

Well i have always said a lawsuit against youtube.com is not the best idea since youtube is a public resource and cannot be threatened. We will loose the freedom of internet if Youtube looses its way by lawsuits.

Yahoo and Microsoft gain more market share but still Google leads way ahead

After many months of incremental decline, Microsoft rose from an 8.5% share in May 2008 to 9.2% in June 2008. This is likely a factor in Microsoft's rise. By this it has achieved great success but at the same time Microsoft is hoping that program will generate more than a 0.7% rise in its share, and that's all it has gotten so far. Clearly the program isn't a massive initial game changer that some thought it to be. Instead, if Cash back is going to be a success, clearly now it will be something that happens over time. Let's see if that indeed happens in the coming months. The other hand even yahoo too is showing a rise. After months of drops with the occasional rise, Yahoo posts two straight months of gains, i.e. 20.4% in April 2008 to 20.6% in May, then 20.9 percent in June 2008. I think there's great rise in Yahoo & Microsoft. Lets see the actual number of searches each handled versus market share:

Google: 7.1 billion

Yahoo: 2.4 billion

Microsoft: 1.1 billion

Ask: 501 million

AOL: 471 million

By this we can tell that Google still shows a gain. Google went over the 7 billion searches served mark. Whereas Yahoo, at 2.4 billion searches, & Microsoft, at just over 1 billion searches, which didn't break any past records but at least got closer to territory it held a year ago. On the whole there is a great increment in yahoo & Microsoft compared to previous years & Google declined a bit but then too created a record!

Joomla hacking problem reported - a warning message

"I have uncovered some malicious activity on my website which seems to be based around a Joomla/server vulnerability. I am still analysing the extent of the problem but here is what I have found so far. After performing a backlink check on my website I noticed a lot of links coming into the website with an anchor text of "F". Many of these websites seem to be genuine businesses (whether they actually are or not is still being debated), however the link itself was hidden in a mass of hidden links only visible by disabling CSS. When I say a mass of links I am taking 100s. After further investigation I found the cause of the problem, a script file called phpgw.php. Somehow the server has been hacked and the file called phpgw.php had been placed in a folder called "images/stories". From what I can see this script pulls in the template file for the website and modifies the code to contain the spam links. The story continues....I pulled up the access logs for the website and there was only one reference to the phpgw file from the IP address 212.62.97.20, a Saudi Arabian company who seem to be known for content spamming and malicious linking, see the following URL: http://www.projecthoneypot.org/i_b387d0cd6f471d4ce6e0535228689b7d Whether this is a server issue or a Joomla issue is still un clarified (I assume it's a bit of both) but I warn Joomla users to disable CSS, check for spammy links, and check the server for the phpgw.php file. I'm still looking into the situation so I'll update you all if I find out anything else. "

This looks like an issue that needs immediate attention since link injection is not only bad for your site but very bad for SEO. If Google crawls your site and find links to spammy websites it will ban your site temporarily or in rare cases permanently out of their index. We had a client face the same problem where his site was hacked and he got the following email from Google

"

Dear site owner or webmaster of ***********,

While we were

indexing your webpages, we detected that some of your pages were using

techniques that are outside our quality guidelines, which can be found here:

https://www.google.com/webmasters/guidelines.html. This appears to be because

your site has been modified by a third party. Typically, the offending party

gains access to an insecure directory that has open permissions. Many times,

they will upload files or modify existing ones, which then show up as spam in

our index.

The following is some example hidden text we found at

****************

*

*

*

In order to preserve the quality of our search engine, we have

temporarily removed some of your webpages from our search results.

The mail from Google was actually longer which is cut short here. Matt cutts webspam head also posted an entry in his blog on how to help hacked sites https://www.mattcutts.com/blog/helping-hacked-sites/

You can see from matt's post that Google is not happy with hacked website with malicious and spam links. I warn everyone who use vulnerable content management systems like Drupal, Wordpress, Joomla etc to patch all possible vulnerabilities.

If you are using wordpress i recommend downloading the latest version "http://wordpress.org/download/" and installing on your server

For Drupal too latest version works.

For joomla if you find installing the latest version all over a bit difficult i recommend just patching all the loopholes using their security extensions here http://extensions.joomla.org/index.php?option=com_mtree&task=listcats&cat_id=1802&Itemid=35

Have a safe site Google and every search engines love sites that are user friendly and safe for browsing.

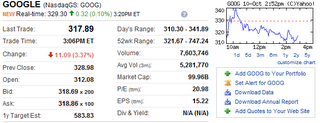

Google ( Goog ) Gains more than 12% after Q1 2008 RESULTS

At this moment Google's shares are trading around 13% increase which is a very good sign for Google.

Financial results Summary as per Google's investor relations:

Q1 Financial Summary

Google's results for the quarter ended March 31,

2008, include the operations of DoubleClick Inc. from the date of acquisition,

March 11, 2008, through the end of the quarter, and are compared to

pre-acquisition results of prior periods. The overall impact of DoubleClick in

the first quarter of 2008 was immaterial to revenue and only slightly dilutive

to both GAAP and non-GAAP operating income, net income and earnings per

share. Google reported revenues of $5.19 billion for the quarter ended March 31,

2008, an increase of 42% compared to the first quarter of 2007 and an increase

of 7% compared to the fourth quarter of 2007. Google reports its revenues,

consistent with GAAP, on a gross basis without deducting traffic acquisition

costs, or TAC. In the first quarter of 2008, TAC totaled $1.49 billion, or

29% of advertising revenues. Google reports operating income, net income, and

earnings per share (EPS) on a GAAP and non-GAAP basis. The non-GAAP

measures, as well as free cash flow, an alternative non-GAAP measure of

liquidity, are described below and are reconciled to the corresponding GAAP

measures in the accompanying financial tables.

GAAP operating income

for the first quarter of 2008 was $1.55 billion, or 30% of revenues. This

compares to GAAP operating income of $1.44 billion, or 30% of revenues, in the

fourth quarter of 2007. Non-GAAP operating income in the first quarter of

2008 was $1.83 billion, or 35% of revenues. This compares to non-GAAP operating

income of $1.69 billion, or 35% of revenues, in the fourth quarter of 2007.

GAAP net income for the first quarter of 2008 was $1.31 billion

as compared to $1.21 billion in the fourth quarter of 2007. Non-GAAP net

income in the first quarter of 2008 was $1.54 billion, compared to $1.41 billion

in the fourth quarter of 2007.

GAAP EPS for the first quarter of 2008 was

$4.12 on 317 million diluted shares outstanding, compared to $3.79 for the

fourth quarter of 2007 on 318 million diluted shares outstanding. Non-GAAP

EPS in the first quarter of 2008 was $4.84, compared to $4.43 in the fourth

quarter of 2007.

Non-GAAP operating income, non-GAAP operating margin,

non-GAAP net income, and non-GAAP EPS are computed net of stock-based

compensation (SBC). In the first quarter of 2008, the charge related to

SBC was $281 million as compared to $245 million in the fourth quarter of

2007. Tax benefits related to SBC have also been excluded from these

non-GAAP measures. The tax benefit related to SBC was $51 million in the

first quarter of 2008 and $42 million in the fourth quarter of 2007.

Reconciliations of non-GAAP measures to GAAP operating income, operating margin,

net income, and EPS are included at the end of this release.

GOOG Financial results.

Google's stock ( GOOG ) rise among speculation by an analyst

Google (nasdaq: GOOG )'s stock rose $17.99, or 4 percent, to $473.27 among early trading on Friday after Analyse Jeffery Lindsay predicted higher sales and revenue for Google from its search engine advertising programmes. Lindsay said after Google's new approach to AdWords its sales will be increasing in the coming Months.

According to Lindsay Google has been slapping low quality advertisers from their AdWords advertising platform which gives opportunities for reforms to the AdWords campaign. Com score a leading company which tracks clicks in search engines reported lesser number of clicks in February and march but Lindsay says this is mostly due to Google slapping lower bidding advertisers and increasing its price facilitating for higher advertisers. Google has been changing and increasing its AdWords bid prices for a long time and according to Lindsay Com score don't record all these information.

Linday also predicts Google's shares might rise as high as 750$,

Source:forbes.com/feeds/ap/2008/04/04/ap4856278.html

Labels: Goog